defer capital gains tax canada

Deferral election is not taken but can claim CCA. In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States.

Deferring Capital Gains Tax When Selling Art

Claiming a capital gains reserve.

. This deferral applies to dispositions where you use. E the proceeds of disposition. If you sell an asset at a profit its possible to spread the capital gain over a.

Balance out your capital losses. Deferred Capital Gains Taxation. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free.

If you sell 1000 worth of ABC stock and 2000worth of XYZ stock in the same calendar year your net gain is 0 since the gains from. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. Since 2001 all capital gains are taxable in.

Capital gains may be claimed if you are. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021.

January 1 2022 is the 50th anniversary of the capital gains tax. This article briefly explains the treatment of capital gains deferral for investment in small businesses under the Canadian tax law. Deferred capital gains taxation refers to taxes that are only applied to the gain in value on an investment.

D the lesser of E and the total cost of all replacement shares. Claim a capital gains reserve. In Canada you only pay tax on 50 of any capital gains you realize.

In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act. However sometimes you receive the amount over a number of years. Capital gains deferral B x D E where.

Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly. B the total capital gain from the original sale. Here are six creative ways to defer a tax bill until a future year.

No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale. Use the IRS Primary Residence Exclusion If Applicable While not specifically related to the sale of a commercial property IRS rules allow taxpayers to reduce. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

A Brief History of the Capital Gains Tax in Canada. Canada does not have capital gains tax. Under the current Canadian federal income tax rules when a rental real estate property is sold the owner must pay tax on the recaptured CCA at up to 48.

When you sell a capital property you usually receive full payment at that time. Section 44 applies to a property that. In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States.

Generally the timing of the tax is controlled by. TAX DEFERRAL ON REINVESTMENT. Comments for Deferal of capital gains.

1972 - it started with a 50 Inclusion Rate and all prior.

How Capital Gains Tax Works In Canada Nerdwallet

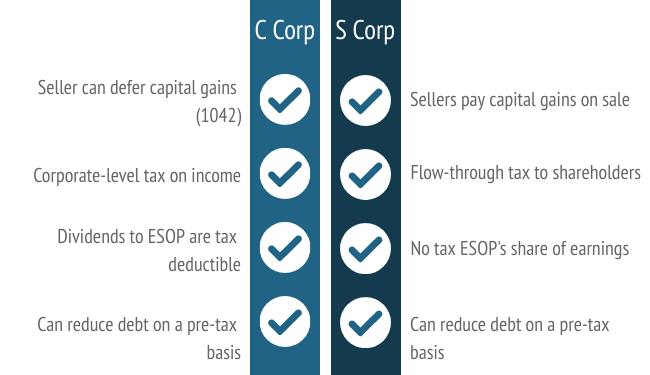

Esop Tax Incentives For Selling Shareholders

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

How To Pay Less Capital Gains Tax

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Capital Gains Tax In Canada Explained Youtube

Six Ways To Avoid Capital Gains Tax In Canada 2022 Wealthsimple

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax Calculator For Relative Value Investing

Doing Business In The United States Federal Tax Issues Pwc

How Are Dividends Taxed Overview 2021 Tax Rates Examples

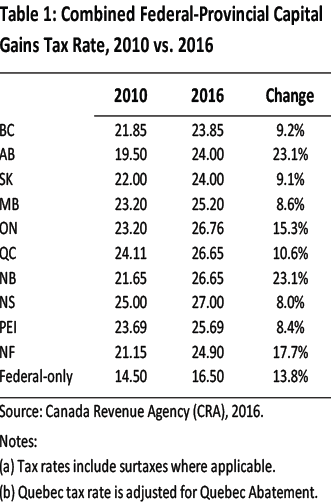

Personal Income Taxes And The Capital Gains Tax Fraser Institute

Minimizing Home Sale Capital Gains Tax In A Divorce Divorce Mediator And Divorce Financial Analyst

How To Avoid Capital Gains Tax In Canada Remitbee

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How Do I Report Capital Gains In British Columbia

Capital Gains Tax On Stocks What You Need To Know The Motley Fool